How many digital currencies are there

By Kathy MarxCryptocurrency Investment Strategies

How many digital currencies are there

Kathy Marx provides an analysis of the current landscape of digital currencies as of Thursday, January 22, 2026 at 02:39 AM, highlighting the increasing number of options available for consumers and investors.

Digital currencies refer to various types of currency that exist exclusively in digital form, utilizing blockchain technology to enable secure transactions. As of early 2023, there are over 22,000 distinct digital currencies in circulation, reflecting a remarkable expansion in the cryptocurrency market since Bitcoin’s inception in 2009. The increasing number of digital currencies leads to diverse applications, ranging from traditional financial transactions to specific use cases like decentralized finance (DeFi) and non-fungible tokens (NFTs).

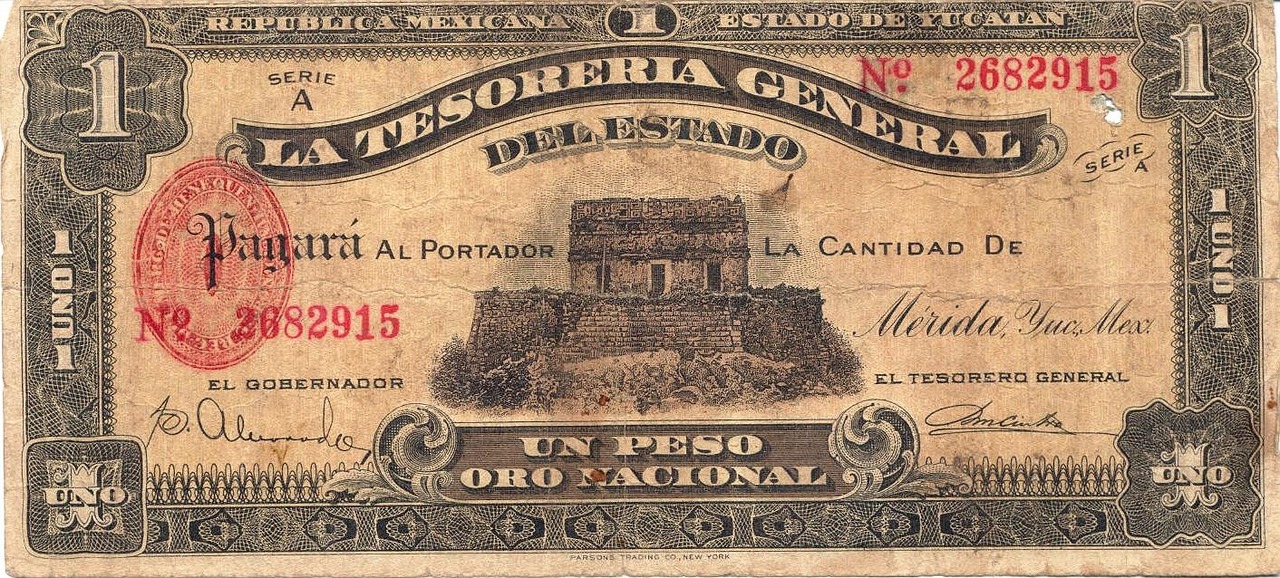

Image: This image illustrates the concept of digital currencies in relation to traditional currencies.

Digital currencies can be broadly classified into three main categories: cryptocurrencies, stablecoins, and central bank digital currencies (CBDCs). Cryptocurrencies, such as Bitcoin and Ethereum, emphasize decentralized and permissionless usage. Stablecoins, like Tether and USD Coin, are tied to traditional fiat currencies to mitigate volatility. CBDCs are state-backed digital currencies that aim to modernize payment systems while retaining government control over monetary policy. Current landscape of digital currencies

Image: This visual represents different categories of digital currencies and their primary characteristics.

In practice, users often seek to compare digital currencies based on various criteria, including transaction speeds, security features, and use cases. For instance, Bitcoin operates on a proof-of-work consensus mechanism, which is slower compared to Ethereum’s proof-of-stake model, making the latter more suitable for rapid transactions. Additionally, stablecoins offer reduced volatility, making them attractive for transactions where price stability is paramount.

Digital currencies generally present certain tradeoffs. They may not be the best choice for individuals seeking to conduct high-value transactions quickly, particularly in markets that are heavily regulated. For high-volume or institutional transactions, traditional financial systems may prove more efficient and secure. Also, new entrants in the digital currency market can lack liquidity, leading to potential price fluctuations that may deter users from engaging with them. Various types of currency that exist exclusively in digital form

1. Assess the security features of different digital currencies.

2. Evaluate transaction speeds and fees associated with each currency.

3. Determine the use case or purpose each digital currency serves.

4. Analyze the community and developer support for the currency.

5. Investigate regulatory considerations in your jurisdiction.

| Category | Examples | Key Characteristics |

|—————————|————————|————————————|

| Cryptocurrencies | Bitcoin, Ethereum | Decentralized, volatile |

| Stablecoins | Tether, USD Coin | Pegged to fiat, reduced volatility |

| Central Bank Digital Currencies (CBDCs) | Digital Yuan, Digital Euro | Government-backed, regulated |

The expanding digital currency landscape presents numerous opportunities and challenges. A 2021 report from the Cambridge Centre for Alternative Finance indicated that over 300 million people globally have used cryptocurrencies, showcasing their rapid adoption. Various types of currency that exist exclusively in digital form

Similarly, a 2022 survey by Statista indicated that more than 40% of millennials are likely to invest in cryptocurrencies, suggesting a strong interest in digital assets among younger investors. However, profound risks exist, including regulatory uncertainties and cybersecurity threats that continue to evolve as the technology and market mature.

Choosing a digital currency involves understanding these risks and offering considerations tailored to specific investment strategies. Users should carefully weigh the potential benefits against the inherent risks before investing in digital currencies. Stakeholders must stay informed about market trends, technological advancements, and regulatory changes to make well-informed decisions regarding digital currency investments.

In conclusion, the digital currency market continues to grow and diversify, with thousands of options available to users. Recognizing the features and limitations of each currency type allows investors to navigate this complex landscape and identify opportunities aligned with their financial goals.

What constitutes a digital currency and how does it differ from traditional currency?

Digital currency refers to money that exists only in electronic form, using cryptography for security. Unlike traditional currencies issued by governments, digital currencies can operate independently on decentralized networks, such as blockchain technology, raising questions about their stability and regulatory standing. However, this introduces tradeoffs that must be evaluated based on cost, complexity, or network conditions.

How are digital currencies utilized in daily transactions compared to fiat money?

Digital currencies can be used for online purchases, remittances, and investment opportunities, often providing lower transaction fees than traditional banking systems. However, their acceptance in physical stores is limited, which can complicate their use in everyday transactions.

Are there alternatives to digital currencies that serve similar purposes?

Stablecoins are an alternative that aims to maintain a fixed value, often pegged to a fiat currency like the US dollar, which helps mitigate volatility associated with other digital currencies. However, relying on stablecoins can introduce counterparty risk, as their value is dependent on trust in the issuing entity.

Author: Kathy Marx

Kathy Marx is a cryptocurrency blogger who focuses on the investment potential of digital currencies. With a background in financial analysis, Kathy's blog offers insights into market trends, investment strategies, and risk management. Her content is designed to help readers make informed investment decisions and navigate the volatility of the crypto market. Kathy’s clear and practical advice makes her blog a go-to resource for investors looking to enhance their understanding of cryptocurrency investments.

Archives

Categories

- Best Crypto Investments

- Bitcoin Investment Strategies

- Bitcoin Price Forecasts

- Bitcoin Trading and Investment

- Blockchain Fundamentals

- Chainlink Market Insights

- Crypto Day Trading Guide

- Crypto Market Trends

- Crypto Trading and Investment Guides

- Crypto Trading Insights

- Cryptocurrency Investment Strategies

- Cryptocurrency Wallets Guide

- Meme Coin Guide

- NFT Fundamentals and Usage

- Online Stock Trading

- Ripple Investment Guide

- Shiba Inu and Dogecoin Updates

- Trading and Investment Apps

- Valuable Coin Guide